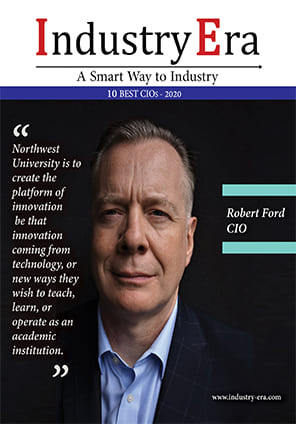

Kent Llewelyn

CIO & CTO TAB Bank

“A True Innovator”

Kent Llewelyn, CIO & CTO of TAB Bank leverages a strong skill set of embracing the concept of building for durability and flexibility. Over time, these principles have actually assisted in lowering the cost of delivery and continuous improvement. Being passionate about finding the best way to build and deliver versus the most expedient, Kent thinks big and dreams bigger. He has a knack for taking the most complex scenarios and illustrating them in a way that makes them feel achievable. His optimism and confidence drive the initiatives of TAB Bank and fosters a belief amongst others that they can do anything. Armed with an infectious determination attracting those that share his excitement for innovation, Kent is never satisfied with the status quo, and continues to push the envelope not shying away from a challenge. The key initiatives that he has taken on while in his role at the bank are simply astounding—Open Banking, mobile & online banking platform, API gateway, core-agnostic & centralized data.

"TAB Bank customizes solutions to serve the needs of small- and medium-sized commercial businesses across the US. With lasting commitment, we provide working capital solutions, equipment financing and deposit products during all stages of our customers’ business life cycle in any economic environment."

TAB has been investing and building a data-centric design that will allow the delivery of services to be custom to the user. This will be reflected not only in the ease of use between roles but will bring specific solutions that are driven by JTBD (Jobs to be Done) analysis. This design will bring a platform structure to delivery that allows the user to choose the services, guided by the AI supporting the interactions. TAB currently provides completely digital solutions in lending and depository services that can be delivered in minutes to hours. TAB is focused on increasing access to small business products when and where the user needs them. “These services are rooted in our history of serving truck drivers over 20 years ago where the customer couldn’t walk into a local branch to do business,” says Kent.

According to Kent, security is paramount in everything TAB does. All data is encrypted at rest and in transit both internally and externally. Multiple layers of security are in place throughout the process to ensure only those with the correct permissions are able to see and interact with the data. “One of the main benefits of building from the ground up is that we get to define the policies for each and every interaction within our API gateway and systems,” he explains. “The API gateway provides the nimbleness necessary to pivot and scale on demand. This unique characteristic allows TAB to simply plug-n-play new fintech services as needed to ensure our product and feature offerings are always top-notch.” The flexibility they have gained from this API driven approach has allowed them to stand-up services like open banking in multiple formats such as PSD2, FDX and OFX, creating capabilities of offering both Banking as a Service and Banking as a Platform for would be fintech partners looking for a technology first bank.

TAB’s goal is to build the premier small business banking platform. This is done by digitizing every possible aspect of their interactions with customers. TAB’s aim is to become agile and create a platform that allows for seamless integration with the best of breed solutions. The bank’s new mobile & online banking platform will be released later this year. TAB will also be releasing their Open Banking APIs with a fully functional sandbox to allow potential partners to build and interact with the APIs of their choosing. The ease of use will guarantee TAB to be among the top choices of fintech partners. Kent will be spearheading various massive changes for the days to come and believes that leaders should never stop learning from others at all levels. Advising the future leaders, Kent says, “Be a leader and mentor, never a boss. This will attract the most competent and talented individuals while building superior loyalty.”IE

Company

Management

Kent Llewelyn

CIO & CTO TAB Bank

Description

TAB Bank was born in Ogden, Utah in 1998. When we first opened our doors to business, we had no way to predict the expansive growth spurt we would soon experience. What we did know is that we had a mission to work relentlessly to help people build businesses, turn ideas into action, capitalize on opportunities, and capture their piece of the American dream. So, we did. Nobody knows the trucking industry better than we do. Nobody. That’s because we first started out as a banking service that operated inside the truck stops. What does TAB stand for? Transportation Alliance Bank – which pulls from our deep roots in the trucking industry.