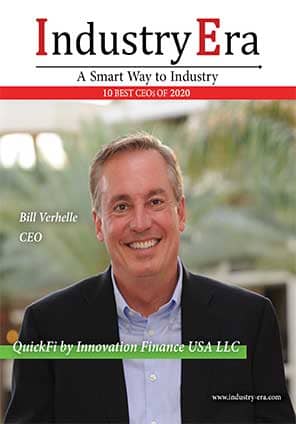

Bill Verhelle

CEO QuickFi Innovation Finance USA LLC

“Pioneer of 100% Digital, Business Lending Platform”

Bill Verhelle is an innovative industry leader who prioritizes transparency and trust in his business dealings. Bill and his colleagues translated these qualities into the QuickFi product. As the CEO, Bill’s mission is for QuickFi to become the most trusted and transparent commercial lending platform in the world, by integrating the most advanced technologies into an entirely new banking business model to revolutionize equipment financing for small and medium business (SMB) borrowers.

"QuickFi Uses A.I., Blockchain, Facial-recognition to Revolutionize Business Lending "

According to Bill, traditional business equipment financing is broken. Borrowers pay too much, in a needlessly time-consuming process. The existing business model is also opaque and inefficient for borrowers. Business borrowers must negotiate with loan officers or other salespeople, who are primarily tasked to retain fees and interest rate enhancements for the banks or independent lenders. Multiple rounds of negotiation often occur on each new equipment loan or lease. Although often friendly, the process is needlessly adversarial and inefficient. QuickFi improves the customer experience and is revolutionizing the equipment financing industry. QuickFi enables a streamlined, all digital, self-service financing experience. QuickFi’s mobility and accessibility enable business borrowers to consummate financing on their own time (24/7/365) with speed, simplicity, and transparency.

The QuickFi platform is comprised of an advanced (patent pending) micro technology recipe which streamlines and completely automates the equipment financing transaction. The QuickFi mobile application is the tool borrowers use to initiate and complete equipment financing on their own time without lender involvement.

After establishing a QuickFi account (in a matter of minutes) there are three simple steps in the QuickFi transaction process:

1. A borrower uploads equipment invoices (by image capture, file upload, or email forwarding) to the QuickFi mobile application. Artificial intelligence and optical character recognition analyze the invoice data and produce payment quotes for the customer.

2. The borrower selects the term and structure of the loan with only two button taps.

3. A loan contract is created instantly, based on the uploaded invoices and the term and structure options selected by the borrower. With a single digital signature (directly within the QuickFi mobile app) the borrower consummates the loan. The loan proceeds are paid directly to the equipment vendor the next business day.

The simple 3-step QuickFi process is flexible, self-service, and can be initiated and completed entirely by the customer at any location and at any time of the day or night (24/7/365). QuickFi reduces the traditional bank or commercial finance company equipment loan application, approval and documentation process from days or weeks to only three minutes.

Paul Selvidio, CFO of Community School of Naples, works well over 40 hours a week. His responsibilities include not only financing, but operations and financial decision making. With traditional equipment financing, the back-and-forth and constant communications, negotiations, and documentation with salespeople was wasting Selvidio’s valuable time. Selvidio praises QuickFi for the seamless, one-time account setup process and the financing transaction process that takes “…virtually seconds, from start to finish.” Selvidio also notes that QuickFi’s mobility and accessibility of data are “revolutionary.” All equipment financing data, including upfront disclosed interest rates, invoices, contracts, billing information, and transaction history are always available in the QuickFi app. Selvidio states, “[QuickFi] streamlines the decision-making process.”

QuickFi also offers solutions for global business equipment manufacturers and banks. Innovation Finance is currently piloting a QuickFi portal with several global manufacturing partners. The QuickFi mobile app's automated processes directly connect to the QuickFi Portal for dealer environments, to facilitate in-person dealership borrower onboarding. QuickFi also has the capability to integrate with manufacturer or dealer web shopping carts to facilitate nearly instant term financing of business equipment acquired on-line. Together, these capabilities enable QuickFi to bring instantaneous, self-service business equipment financing to nearly all types of business equipment acquisitions.

QuickFi’s technology is patent pending in 40 countries, and is currently available in all 50 states throughout the U.S. QuickFi plans to expand to accommodate equipment financing throughout North America (adding Canada and Mexico) eventually expanding into Europe and Asia.IE

Company

Management

Bill Verhelle

CEO QuickFi Innovation

Finance USA LLC

Description

Innovation Finance offers creditworthy borrowers unprecedented access to low-cost capital on the most modern client-accessible lending platform. Founded by the leaders of one of the most successful commercial finance businesses in the U.S., QuickFi is changing the face of commercial lending. In addition to the lowest available rates, QuickFi offers speed, transparency, and a dramatically better client experience.